It’s the end of 2025 and the perfect time to look back at the ultra-fast* pace the EV charging industry in Europe has been moving in for 2025. * charging pun intended

The year 2025 alone has added around 2.5 million new fully electric vehicles to the European roads (ACEA), with over 18% of all cars sold being electric. That’s nearly every fifth car hitting the road in Europe lacking a tailpipe. Just consider that ten years ago, in 2015, EV sales in Europe only meant 89,000 fully electric cars for the whole year.

The charging industry obviously needs to step up to the challenge of charging all of these EVs, or perhaps even be ahead of it a little.

When we zoom out, 2025 does seem like the year that European EV charging moved from just deploying here and there to an actual bloc-wide infrastructure system building.

A few things happened at once:

- Europe quietly crossed 1 million public charging points (ICCT), with fast-charger capacity growing significantly, reaching 202,709 publicly accessible DC chargers by mid-2025.

The biggest growers for DC deployments year-over-year have been Denmark (+79%), Italy (+62%), and Belgium & Austria (both +59%). EV charging trends are very clear here. - Europe is targeting roughly 3 to 3.5 million public chargers by 2030, which means adding several hundred thousand a year, to ~2.2 million chargers across the next five years.

- Policies like Germany’s “Charging Infrastructure Masterplan II” help – it has €6.3 billion in investment earmarked to deploy more chargers in the country, hoping to reach 1 million publicly accessible chargers in the country itself by 2030.

- The policy consensus on EVs started to wobble in 2025. Under heavy pressure from large automakers and certain member states, the European Union has reportedly now planned to soften its 2035 combustion engine ban to a 90% reduction instead.

- At the same time, the EV and charging industry is pushing back, warning that weakening the rules now would slow investment and leave Europe exposed to Chinese and US competition. Muddy waters, for now.

For a charging operator, an EV fleet, or a site host, 2025 is the year the game board changed. Let’s take a look at the 10 largest developments in the EV charging industry in 2025:

1. AFIR kicks in: from scattered chargers to minimum coverage

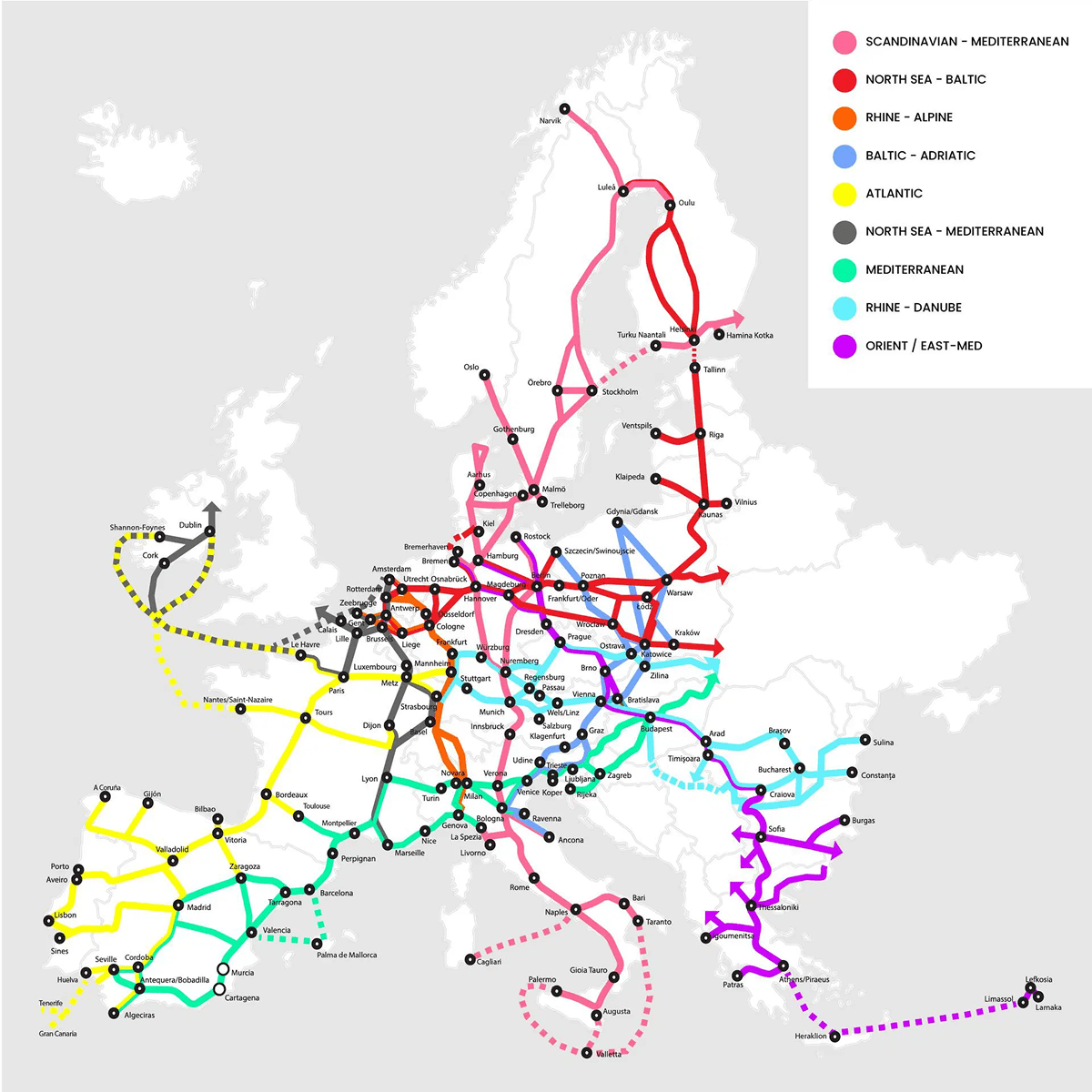

Source: Trans-European transport (TEN-T) network – AFIR map by Kempower

Under the EU’s Alternative Fuels Infrastructure Regulation (AFIR), member states now have hard obligations for public charging on the main TEN-T corridors. By the end of 2027, core parts of the network must have:

- Car charging locations at least every 60 km, with at least 600 kW per site and at least two chargers that can do 150 kW or more.

- Heavy-duty locations with at least 2.8 MW total capacity and 350 kW connectors every 120 km on half of the TEN-T core network, rising to 3.6 MW at every 60 km by 2030.

That is a very different world from the past “two 50 kW chargers in a corner of the parking lot” era.

For operators, AFIR does three important things:

- It sets a floor under the market. Long-haul corridors can no longer be ignored in favour of “easier” urban sites.

- It forces a shift to high-power multi-bay layouts instead of isolated plugs.

- It gives investors a policy anchor at the same time as other rules (like the 2035 engine phase-out) are back on the table.

The end result: 2025 is the year the market started planning in megawatts. However, limits from grid access remains a challenge all across the networks:

2. Grid access is still a problem

One of the key EV charging trends 2025 is actually a limitation that hasn’t been solved.

Grid access, buildouts and permits are a problem for CPOs in nearly every country in Europe in one way or another. In fact, based on Driivz’s survey of 300 Charge Point Operators (CPOs) & charging-related employees in Europe and North America,more than 90% of these companies brought out one key issue – they expect grid capacity to hinder their growth over the next 12 months.

So this is clearly a limiting factor, both actual rollout-wise, and for the time & cost it takes to deploy.

Luckily, solutions are emerging. These should boost the infrastructure rollout speed significantly by 2030 compared to today.

One of such is technological advancement from the charger equipment side itself: quite a few providers these days, even in our Central and Eastern European regions, offer battery-buffered chargers, where the grid load for high-power charging is offset by a battery integrated to the charging hardware.

This means that, for example, a 350 kW charger wouldn’t necessarily need to pull that out of the grid immediately, and thus, grid connection can be scaled to be less. Pairing that with smart software for dynamic load management, it’s a solid step in the right direction, even if not fully solving the underlying grid connection sizing problems.

Another solution is to scale up the grid capacity that a charging hub needs on site, but not relying on the grid itself – instead, some operators opt for the ”bring your own power” approach, by building out a renewable power solution (mostly solar for obvious reasons) next to the charging site.

A good example of that comes from our recent research on the largest EV charging hubs in the world, as those need remarkably large grid connections. Although located across the pond, it’s a great one to showcase due to the massive size they’ve undertaken:

Tesla’s Oasis Supercharger in California, with 168 Superchargers (!), is mostly running fully off-grid thanks to the 11 MW solar array that they’ve built next to the site. The system also has ten Tesla Megapacks connected to it for 39 MWh of storage, making it a solid microgrid buildout just for the huge charging site.

We also see an increasing number of solar+charging buildouts in Europe, with a great visible example of that being the Seed & Greet location in Kreuz Hilden, Germany – all 62 DC stalls from several brands station sit beneath a 1 MWp solar canopy, and feed from an on-site 2 MWh battery system.

While modernizing the grid feels as slow as a snail in Europe these days, the charging infrastructure builders have no other choice but to build out smarter and more efficient solutions.

There’s another solution to help the grid and fast charging infrastructure along that has been a part of EV charging trends for a long time now. And the key here is the EV itself:

3. V2G Charging – are we finally there?!

The benefit of Vehicle-to-Grid (V2G) charging is obvious, just hard to execute. A well incorporated V2G system means an EV can be charged at an optimal time, say when renewable energy production is abundant on the grid, and the energy can be given back to the grid during the grid’s peak demand times, like people arriving home after work.

Talks of V2G pilot projects seem to be almost as old as the modern era of electric vehicles themselves… mostly from around 2012 or so. In fact, I can even remember studying the Utrect, Netherlands project about creating a smarter ‘microgrid’ with solar and EVs. Well, this year, I’m happy to say that projects like these, and even kind of led by the very same city, have come a lot closer to everyday use.

In Utrecht, Renault Group, We Drive Solar and MyWheels switched on what is currently Europe’s largest V2G car-sharing project:

- 50 Renault 5 E-Tech EVs live today, scaling to 500 V2G-capable vehicles, feeding power back to the grid using bidirectional chargers. The fleet will soon include the Renault 4 E‑Tech electric, Renault Megane E‑Tech electric and Renault Scenic E‑Tech electric.

- The project budget is around 100 million euros, and it directly targets local grid stability problems.

One of the key EV charging trends in 2025 and 2026 is the rollout of these systems at a larger scale.

But how far am I personally from sending electricity from my EV to grid?

We can finally say: really close.

There are now larger rollouts of both consumer-focused V2G wall chargers to be used at home, and larger V2G project rollouts across the countries. You can now find anyone from Kia and Hyundai offering V2G as a commercialised, customer-focused service in the Netherlands from the end of 2025 (for Kia EV9 and Hyundai Ioniq 9), to Mercedes-Benz and Renault partnering with The Mobility House to bring this to life in Europe, with such offer starting with the electric CLA.

2026 will see a large selection of EV models come with the V2G support by default, or some previous models having it unlocked with nothing but an over-the-air software update. Now all you need is a compatible V2G charger and the bidirectional energy flow is good to go.

The direction we are moving towards is quite clear: the current grid will be increasingly bolstered (and replaced) with renewables, and both battery energy storage systems and EVs as batteries on wheels help give it all the stability it needs. The EU estimates we could offset about 25% of the €584B in grid upgrade needs with the V2G rollout.

4. The charging industry is becoming mature, and so are the CPO funding rounds. Acquisitions and mergers ahead!

The EV charging trends of 2025 found some charging networks in Europe going for absolute records in our industry in terms of funding added, and what also matters is where it comes from.

Two headline examples:

IONITY secured financing of up to €600 million, including €450 million in committed green loan facilities and an option to increase the credit line by up to €150 million later for future growth.

This loan transaction, provided by nine international commercial banks, is the largest such financing in the European EV charging industry to date and supports the plan to more than double its existing network of over 5,000 charging points across more than 700 locations.

Electra secured a €433 million green loan, bringing its total financing above 1 billion euros since 2021, with around 500 DC fast charging stations live and a target of 2,200 by 2030.

And these weren’t the only rounds, with both international commercial banks and the European Investment Bank (EIB) providing the support for many CPOs across Europe, alongside with the funding rounds of AFIF, the most recent round of which sends out €600M across 70 charging projects.

Why are the large EV charging operator financing rounds important? In addition to the sheer size of the funding rounds, the important bit is how these were financed – through institutional loan financing, instead of equity rounds.

With some equivalent examples also taken place in the US side, like EVgo’s $225M financing this year, it is a clear sign that the large institutions are now looking at the already-built charging networks as stable assets to loan against, and the business models are looking sustainable with actual revenue coming from network-wide utilization.

This, in turn, will likely lead to a second-order effect that is yet to come for 2026: it is likely we will also see consolidation happening within the industry, as the larger players with better financing options start swallowing up smaller charging networks and can introduce further efficiencies across the networks. In addition to that, since the competition is heating up, more EV charging networks might find trouble in finding utilization across all those network partnerships they’ve made to roll across countries.

The European charging landscape is incredibly diverse across different countries and many players, yet Eleport remains one of the handful of operators with a footprint that spans across more than just its home turf, with five countries and counting.

5. From “ultra-fast” to “megawatt” chargers

A very clear part of EV charging trends in 2025 was the average charging power deployed increasing significantly. Over 350 kW deployments per charge point are nothing to be surprised about nowadays, even if most EVs still can’t reach it on their side yet.

Now, we’ve got two EV charging trends 2025 that have exploded upwards and both have got something to do with megawatt charging.

First one is a bit easier to spot, something coming for a few years now – electric truck charging goes into megawatts. While a lot of charging networks – and some of the European funding mechanisms – also bank on building a strong ~400 kW CCS2 type coverage for electric trucks, we now see an emergence of Megawatt Charging Standard (MCS) networks, which go 1MW+ per plug.

There are already several hubs built in Europe that feature the first MCS chargers, and biggest player in the e-truck charging space in Europe right now is Milence. Milence, the Daimler Truck, Traton and Volvo Group joint venture, has set a target of 1,700 public truck charging points by 2027, and of these it plans for 284 MCS charging points across 71 locations in ten EU member states. The difference here compared to some other builders is that Milence is actually well underway to hit those numbers.

Per the ICCT, the EU truck fleet will require 22 to 28 GW of charging power by 2030, split across about 150k to 175k private chargers and 60k to 80k public chargers.

Of that, 4000 to 5300 will have to be megawatt-class chargers under the emerging MCS standard, even though they would make up only around 2 percent of total charger numbers.

The other significant development is that certain players are planning to bring 1,000kW+ chargers for passenger cars to Europe in 2026. This approach is spearheaded by the Chinese-but-now-global automaker BYD, which aims to install 200-300 of its ultra-fast (or should we call them mega-fast?) chargers in Europe already by mid-2026.

They have shown it working in China already, and certain EV brands running on BYD architecture like Denza and their own Han L model, which runs on 1000V, can ‘take in’ that power. This means adding about 400km worth of range in just five minutes.

Will the 1000kW charging become a norm for all passenger EVs? Doubt it. But it’s sure to be introduced outside of BYD as well, as we’ve already seen CATL, world’s largest battery maker, produce a drivetrain for this purpose as well.

6. Just deploying chargers isn’t enough anymore – charging competition starts, driver experience and amenities actually matter

If I had to choose one of the EV charging trends in 2025 as my personal favorite as an EV driver, this would be the one.

In parallel with high-power hardware becoming the norm, 2025 made it clear that experience is part of the product.

The focus on the experience of EV charging by charging operators today comes from three really easy reasons:

- EV charging should’ve been very easy and very convenient from the start, it just was underpriotitized. We are now slowly reaching the natural state of things.

- Charging networks are becoming larger and better capitalized, so they have ‘room’ to start building the amenities around their chargers.

- Competition has actually started, with CPOs fighting for their place in EV drivers’ charging plans. And that will lead to a much better experience for drivers, as the best overall experience with the least friction naturally wins the competition.

Of course, deploying around existing amenities such as retail shops, gas stations (energy stations), entertainment locations, has always been a specific target for many CPOs due to the larger foot traffic. These also, of course, come with the challenges of their own.

A few examples from this year in Europe:

Fastned has rolled out its dedicated charge stops with their own branded 24/7 shops, cafeterias, children play areas and other amenities.

bk World world as now rolled out their modular charging-site lounges with several partners like Tesla, Fastned and Ionity. Just in December, Ionity and bk World opened its first lounge in Portugal, with six 350 kW chargers on site.

Porsche launched its sixth charging lounge in Leonberg near Stuttgart, with a premium feel all around.

The line between just a charging site and roadside hospitality is blurring. Operators who control high-traffic sites now compete on, in addition to the charging availability:

- Food and coffee quality

- Cleanliness and safety, canopy

- Wi-Fi and work-friendly spaces

- Entertainment on site

- Overall brand feeling

This matters because long-term utilisation depends not only on power, but also on whether drivers actually want to spend 20 to 30 minutes there. Some charging hubs are already becoming a destination rather than just a stop. In fact that’s becoming also evident from Tesla in the US, which has created the Tesla Diner concept just for that.

7. The Central and Eastern Europe and other less-developed EV markets are leapfrogging in EV technology!

Something underrated in terms of charging developments is the regional differences of EV uptake in Europe. While the EV adoption differences have their own reasons, it’s important to realize one specific advantage that we saw this year for the markets that were behind in adoption:

They don’t have to go through the early-day inferior technology and can leapfrog to today’s.

The EV markets that started scaling up a decade ago built up charging networks that had 50 kW as the fast charging standard. Now, the markets that are in the same spot of early large growth, just starting later, can benefit from deploying the 350 kW chargers immediately.

All the charging systems available, not to mention the EV models themselves, are immediately more efficient, smarter, and easier to roll out compared to ‘back then’. Autocharge and Plug & Charge are default from the start, along with roaming apps, smart EV routing, and more. What’s not to love jumping in at this moment?

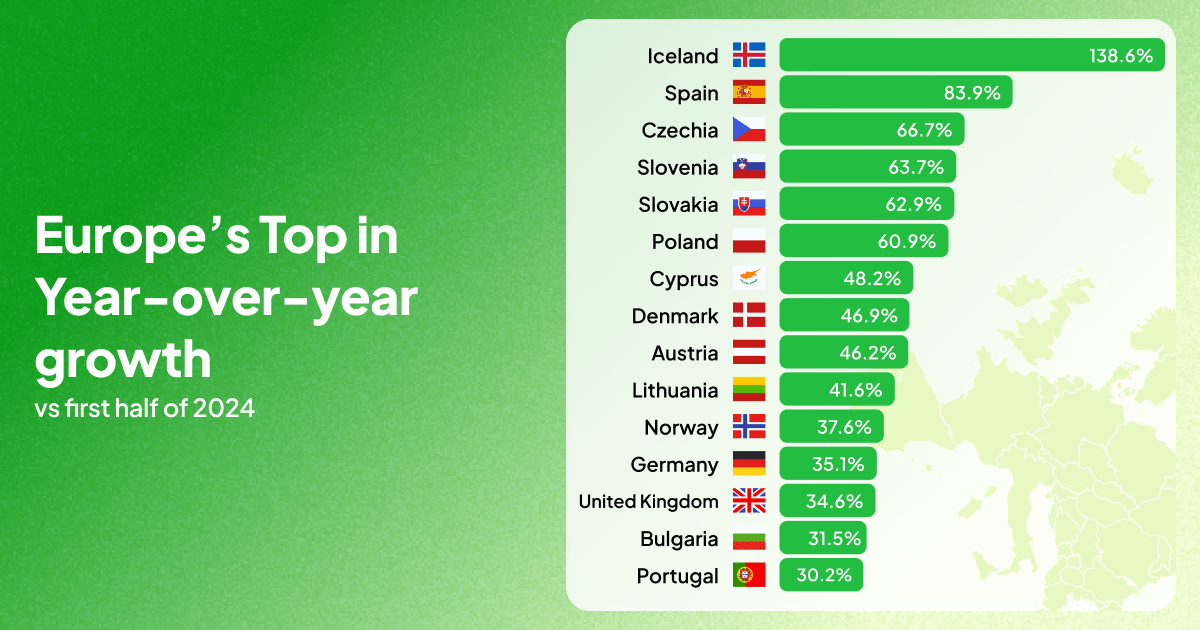

This gives EV adoption in these countries, like Spain, Czechia, Slovenia, Slovakia, Poland that are seeing over 60% year-over-year EV sales growth from a rather small market share base, a great advantage of rolling out great EV systems right from the start. These countries were significantly ahead of the average EV sales Europe growth. EV drivers immediately get a better experience, making the adoption curve that much easier.

8. Wireless charging moves from pilot projects to real products

Wireless charging is the other technology next to V2G that has been in the pilot project phase for so long that some people have kind of written it off by now. However, there are now significant developments outside of the few fleet charging players that have taken place. The most notable from the recent months is Porsche showing that its Cayenne Electric will offer 11 kW inductive home charging from 2026 in selected markets.

The system uses a floor plate with Wi-Fi communication, achieves around 90% efficiency, and starts charging automatically once the car is parked over it. For now it is a premium option, as the price tag for the system is around €2000 for vehicle-side hardware and €5000 for the charging plate. Plus installation.

But it is the first production-ready wireless system from a major European brand and it is aimed straight at customers who like convenience and hate cables. Tesla is working on one on its own, as are a handful of charging companies like HEVO which promise a significantly cheaper option in the works.

Now, wireless charging at home will likely stay a niche for a long time, or perhaps even forever. When it comes to fleet vehicles, workplace charging, or even robotaxis, however, it suddenly makes a lot more sense. We can assume wireless charging as the early stage of EV charging trends 2025 here turns well into a larger rollout towards 2026.

And, as you can read from our latest expert article, yes robotaxis are arriving in Europe already in 2026.

What is 2026 going to bring for the EV charging industry?

As you can see, 2025 was a busy of a year for EV charging industry in Europe. Predicting the future is a thankless job, but we can be pretty sure on the EV charging trends that see technologies maturing and rolling out further in 2026. We’ll be seeing more EV sales in Europe in 2026 than in 2025 with no visible roadblocks other than automaker lobby. We are still early. But the direction of travel is clear. What’s important to note is that EV drivers are still far from always a perfect charging experience. There are still pain points to solve, but I see the 2026 as the year where EV charging trends show a lot more focus is put on making the EV driver’s experiences actually wonderful.