If you’ve seen the news headlines around EV sales, it would be easy to start thinking that perhaps it really was all hype. In this case, the last year should have proved we’re on the way down.

Meanwhile, the real results across Europe in 2025 have proven that EV sales have again been breaking records in nearly every European country. In fact, out of the 31 European countries we analyzed below, only 5 showed a decline in 2025 EV sales compared to 2024.

2 585 187 battery electric vehicles were sold in Europe in 2025. European EV sales grew by a strong 29,7% in the full year of 2025, compared to the 1 992 803 in 2024.

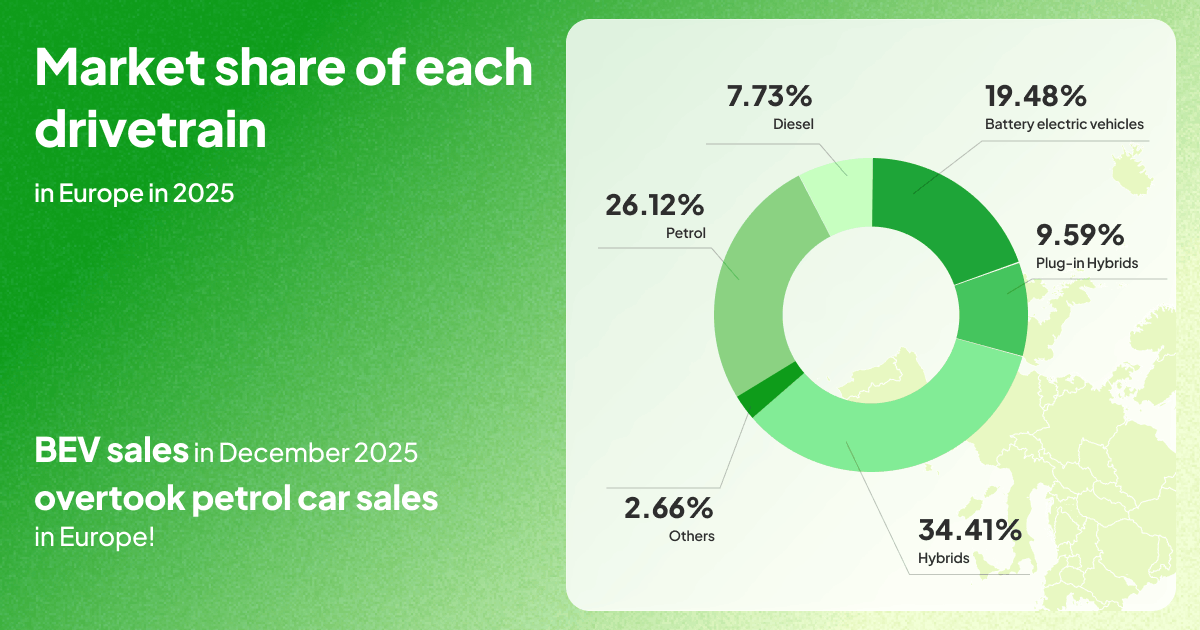

EV market share in Europe is now 19.5%. In other words, nearly every 5th car sold in Europe is currently fully electric! A year ago, the EV sales in Europe made up just 15.4% of all sales.

We still have ways to go, but it is great to see the powertrain shift happen in real time in Europe. Here’s how the European market was divided in 2025:

Not only have battery electric vehicles left diesels far behind them, it is also catching up to the petrol share of the market.

Why does December 2025 go down in European automotive history? Because December 2025 was the first month ever where BEV sales overtook petrol sales!

There’s no better signal that we as Europeans could get that’d show us we ar still on the right path when it comes to EV transition. If we look at the bigger picture, it is clear that the EV future is already here. It is just unevenly distributed.

And we’ll see exactly how it is distributed through our country-by-country European EV sales analysis below, which is based on the ACEA sales data for the year.

* Note: all values for “EV” here are meant as battery-electric vehicles (BEVs) only. Not plug-in hybrids (PHEVs) or any ICE in the data. You can learn more from the EV vs ICE comparison.

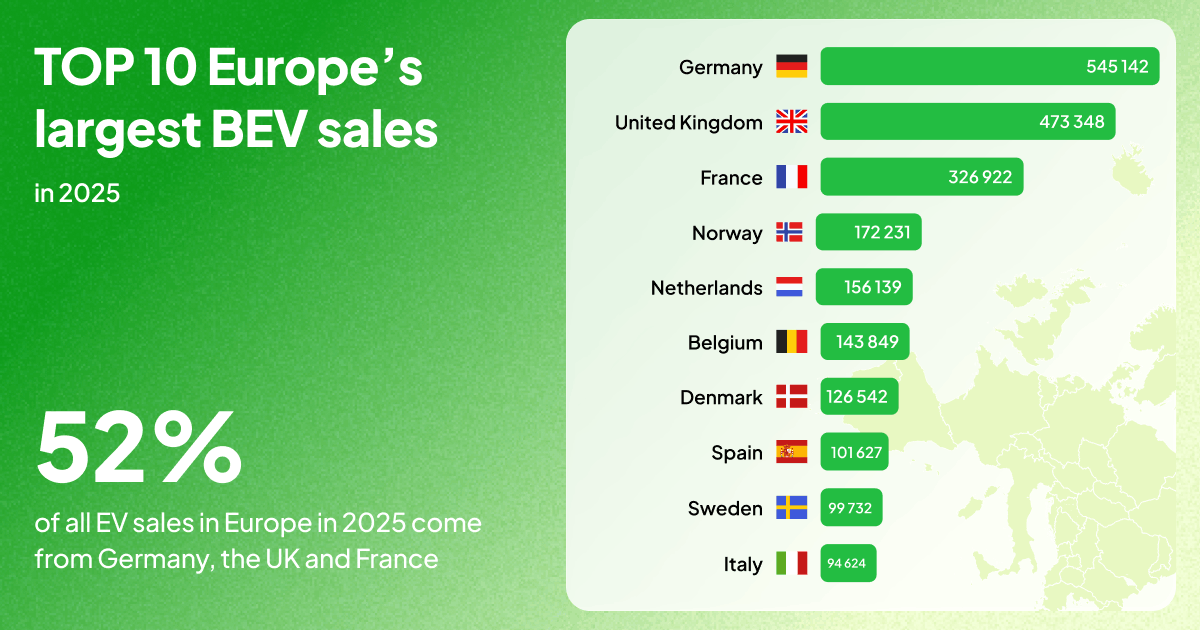

The big three: the largest EV markets in Europe that make up more than half

We’ll start breaking down our Europe EV sales 2025 overview with the three countries where EVs are sold most in terms of units. In fact, put together, these Big Three countries make up 52.04% of all EV sales in Europe:

Germany: 545 142 EVs sold in 2025, growing +43,2% year-over-year. The EV market share rose from 14,6% to 20,1%.

Germany is the largest car market in Europe, and also the largest in terms of EV units sold in Europe. It is interesting to watch Germany’s EV path for obvious reasons – it is where most of our EVs are made, after all. It is especially interesting today, given the rollercoaster ride the EV sales have had in the country recently.

Why did Germany’s EV sales drop significantly in 2024? There was a strong 18.4% → 13.5% EV market share drop in 2024, mostly due to the environmental bonus incentives for EV purchases being suddenly axed mid-December 2023. Luckily, we are seeing a strong bounce back to 20,1%, which means every 5th car sold in Germany is now fully electric.

Next comes a country that has kept right at Germany’s heels for a while now:

United Kingdom: 473 348 EVs sold in 2025, growing +23,9% year-over-year. The EV market share rose from 19,6% to 23,4%.

The growth rate for the UK is nice and steady here, as 2024 and 2023 both showed growth in the 20% range. The market share jump by nearly 4% so far this year is especially significant considering that we are dealing with a large car market here. Nearly every fourth car sold in the UK today is fully electric!

The third spot in units in Europe is taken up by the fourth-largest car market in Europe:

France: 326 922 EVs sold in 2025, growing +12,5% year-over-year. The EV market share rose from 16,9% to 20,0%.

France found its growth gear in the second half of the year, after being in a slight decline in the first part of 2025. This is most likely thanks to the ecological bonus relaunching in late September. France is very slightly beating the European average of 19.5% EV market share, and every fifth car sold in the country is now fully electric.

Now, we’ll continue our European EV sales overview with the countries that have really figured out the EV formula and are truly leading the market in terms of EV adoption:

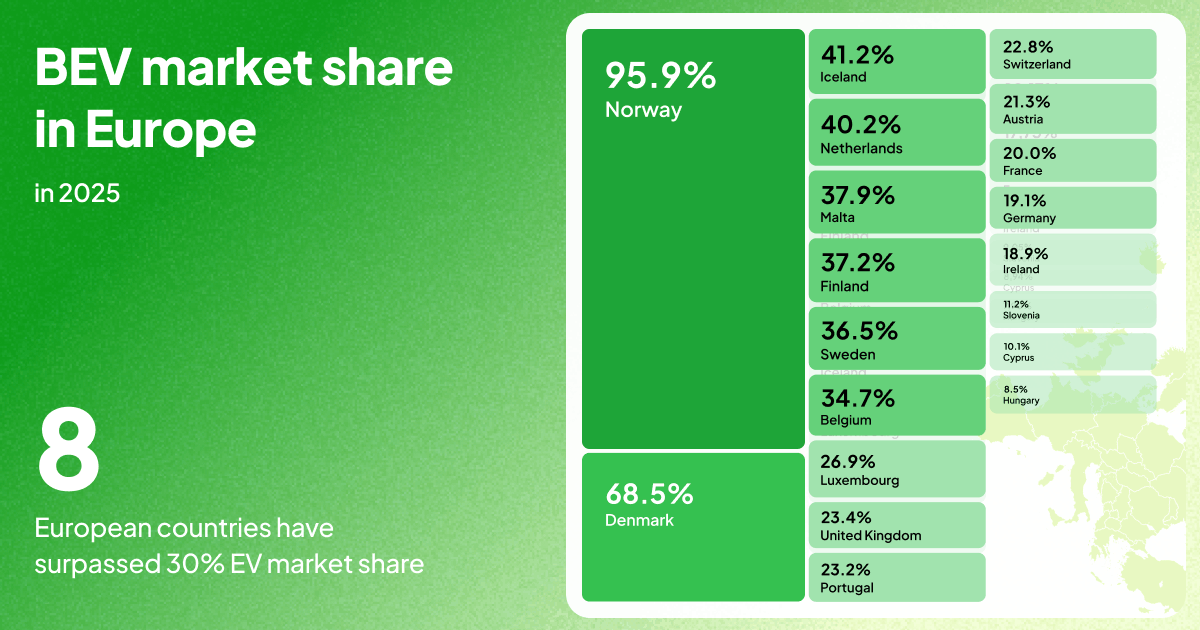

Eight European Countries Are Already at Over 30% EV Market Share!

Yes, you read that right.

Every fourth country in Europe today (8 of 31) is already seeing a third of its all car sales fully electric! So here are the countries that are absolutely winning in EV adoption, ranked from the highest adoption.

The first place in Europe, and in the world, doesn’t come as a surprise to anyone:

Norway: 172 231 EVs sold in 2025, growing +50,6% year-over-year. The EV market share rose from 88,8% to 95,9%.

The 95.9% EV market share means that about every 25th car that is sold in Norway is not a fully electric vehicle.

However, there has been another major success story in terms of EV sales in Europe by market share that has not gotten the attention it deserves, and is something everyone will be talking about soon:

Denmark: 126 542 EVs sold in 2025, growing +42,0% year-over-year. The EV market share rose from 51,5% to 68,5%.

This means more than two out of every three cars sold are fully electric in Denmark. 2025 saw another huge market share jump, a 17% jump – not just 17% compared to last year but by 17 percentage points, just from one year to the next! This is the largest EV market share jump out of all the countries we analyzed in Europe’s EV market this year, and is certainly not easy to do in a market that was already at 51.5% in adoption.

The interesting bit about Denmark’s adoption curve is also that it is progressing faster than Norway ever did – once they got going, it’s happening a lot faster.

Then comes Iceland:

Iceland: 5 988 EVs sold in 2025, growing +125,0% year-over-year. The EV market share rose from 26,0% to 41,2%.

Iceland’s EV journey has been very fascinating to witness. In 2023, Iceland already ended up with 50% of all cars sold fully electric for the full year. But, then by the turn of the year, the government imposed a €0.04/kilometer charge on EVs and revoked the VAT exemption. This caused a significant drop back to 26% EV market share in 2024.

But now, even though EVs got knocked down like this, the sales are still climbing back up: 41.2% of all Iceland’s car sales were fully electric in the year 2025, and the country recorded the second-highest EV growth rate in EV sales in Europe in 2025, more than doubling all EV sales.

Netherlands: 156 139 EVs sold in 2025, growing +18,1% year-over-year. The EV market share rose from 34,6% to 40,2%.

The Netherlands, one of the ‘original’ EV growth markets in Europe, continues on its strong path among the top EV nations of the world, now with more than every third car sold fully electric.

Malta: 2 450 EVs sold in 2025, declining -15,1% year-over-year. The EV market share increased from 37.7% to 37.9%

Malta’s strong decline in EV units is significant, but less so in the latter part of the year (first half was -35% YoY drop), and it should be considered that this comes after almost doubling sales in 2024, and the little island country went from already significant 20.3% → 37.7% market share in just one year. Now, Malta with even its decrease in unit sales managed to slightly grow the EV market share to 37.9%!

Finland: 26 745 EVs sold in 2025, growing +22,3% year-over-year. The EV market share rose from 29,5% to 37,2%.

Finland has done it again! After showing the largest jump in EV market share in 2023 when it went from 17.8% → 33.75%, then experiencing a drop back to 29.3% in 2024, the country is back in the EV growth phase. The 7.7% jump in the EV market share means that now every third new car hitting the road in Finland is fully electric.

Sweden: 99 723 EVs sold in 2025, growing +5,7% year-over-year. The EV market share rose from 35,0% to 36,5%.

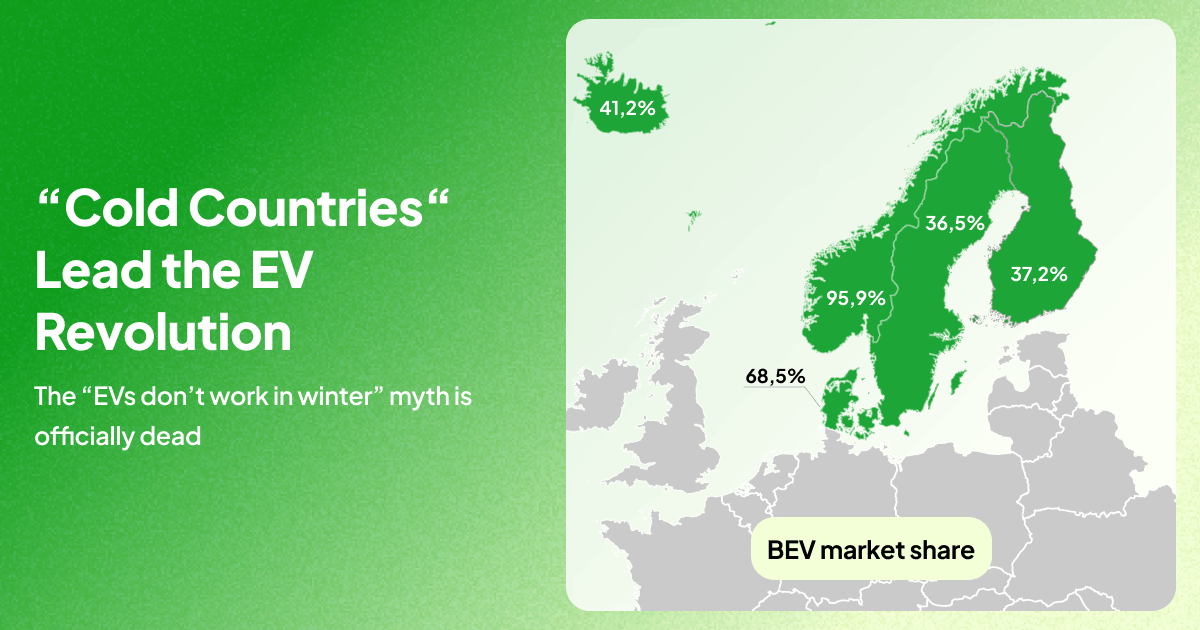

Every third car sold in Sweden is currently fully electric, steadily so. Also, did you notice how it is somehow the colder parts of Europe that are claiming the largest EV adoption? The massive EV uptake in the countries of the northern part of Europe prove very well that the EVs not working in the cold myth is absolutely busted.

Belgium: 143 849 EVs sold in 2025, growing +12,6% year-over-year. The EV market share rose from 28,5% to 34,7%.

These were the 8 countries that are significantly, up to twice or more, ahead of the average European uptake.

Now, let’s look at which markets are emerging, pulling up surprising EV sales growth year over year, even if they’re not as mature EV countries yet:

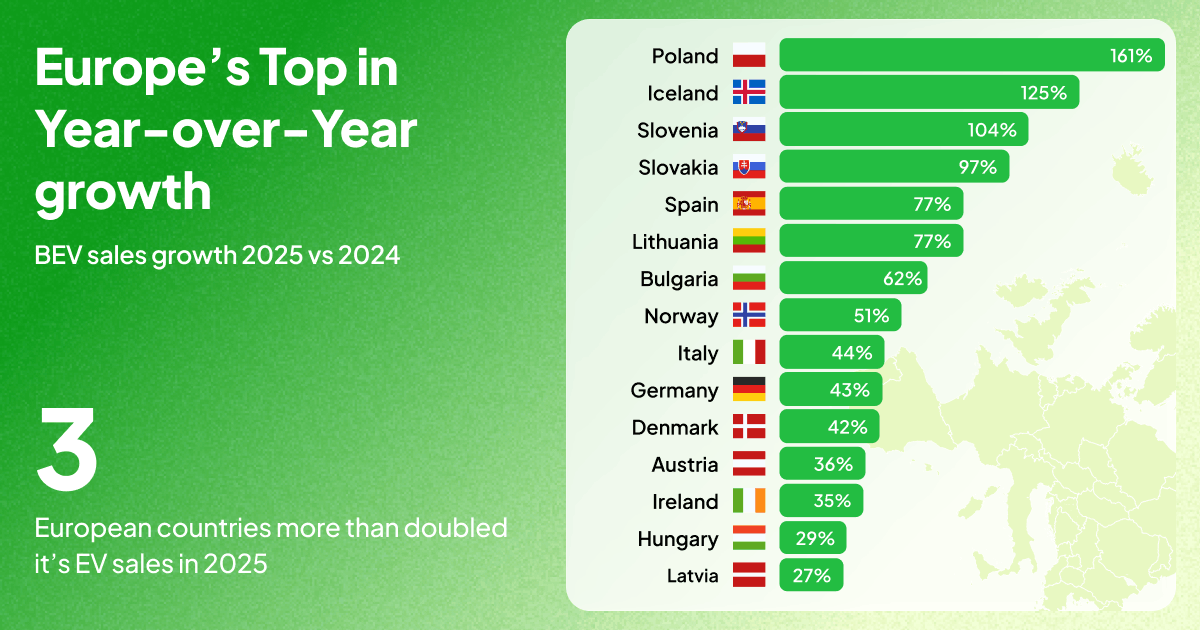

European countries with the largest EV sales growth in 2025

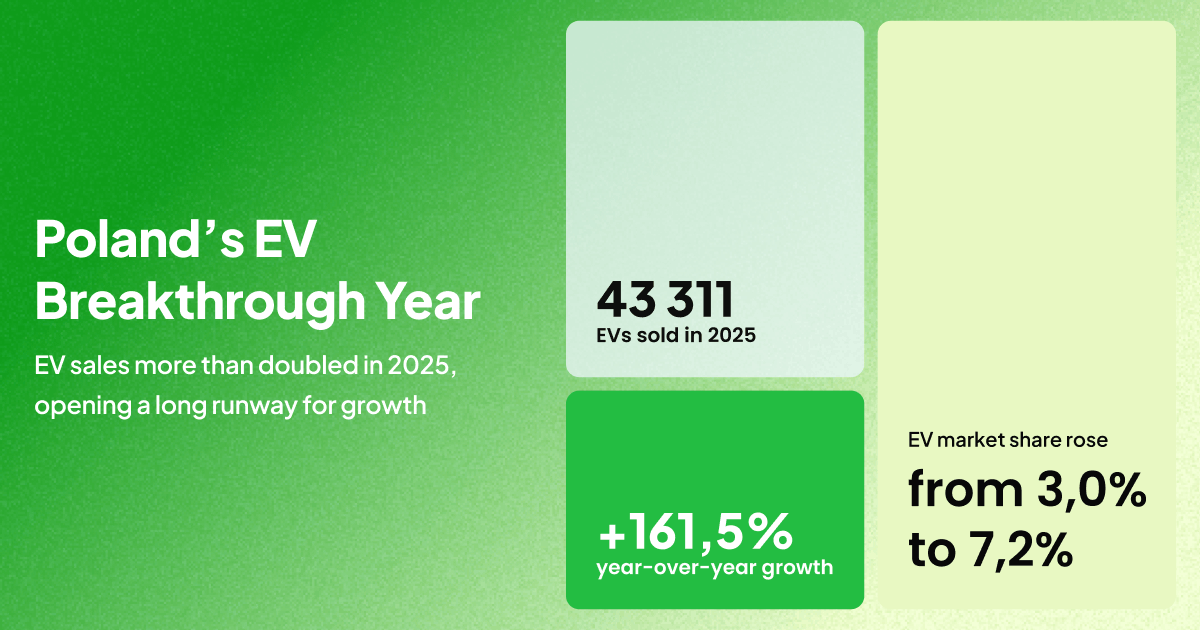

Poland.

Who would have guessed?

Poland: 43 311 EVs sold in 2025, growing +161,5% year-over-year. The EV market share rose from 3,0% to 7,2%.

Poland also took a break in 2024, after growing 51.3% in 2023, and the EV market share even declined from 3,6% to 3% last year. Now, however, the EV sales and the EV market share in all sales have more than doubled in a year.

Poland, as an emerging market took the first spot, and we’ve already talked about the more mature EV market, Iceland, taking the second spot with 125.0% growth in 2025.

The next countries to show big EV growth come in the Central and Eastern Europe region as well:

Slovenia: 6 419 EVs sold in 2025, growing +103,9% year-over-year. The EV market share rose from 5,9% to 11,2%.

After almost doubling EV sales in 2023 (+88.8%), a significant downturn followed in 2024, which made the EV market share drop from 8.85%→5.9%. Now, it is climbing back again, nearly doubling the EV market share & doubling the actual sales.

Slovenia and Slovakia go hand in hand as usual, the latter being just a step earlier on the EV market share ladder:

Slovakia: 4 377 EVs sold in 2025, growing +96,5% year-over-year. The EV market share rose from 2,4% to 4,7%.

As you can see, the EV sales in Europe this year are growing most in the unexpected markets, especially in the CEE region. Tesla’s official entry to the Slovakian market just this January should help it keep going as well. Meanwhile, a much larger car market went EV speed:

Spain: 101 627 EVs sold in 2025, growing +77,1% year-over-year. The EV market share rose from 5,6% to 8,8%.

It’s always great to see large car markets find their real EV “gear”, and Spain, the fifth-largest car market in Europe, going at 77% yearly growth fits this well.

What’s common about these emerging EV growth markets? As we wrote in our EV Charging Trends 2025 article, they have the ability to leapfrog ahead in EV technology, which means the growth can be higher thanks to a lot of new EVs on the market, along with actually suitable charging infrastructure for anyone to jump in, not just the early adopters.

Lithuania: 3 150 EVs sold in 2025, growing +77,1% year-over-year. The EV market share rose from 5,9% to 7,5%.

Lithuania had a great year in EV sales after a drop back in 2024 from pretty much the same level (7.6% market share) it has now achieved again. Hopefully, it continues upwards in EV sales in 2026.

Bulgaria: 2 420 EVs sold in 2025, growing +62,0% year-over-year. The EV market share rose from 3,5% to 4,9%.

After a strong +119% EV growth year in 2023, Bulgaria took a step back in 2024 with 8% less in EV sales, like many of its peers. In 2025, it was making up for it and more, with a strong 62% growth and reaching 4.9% EV market share.

Norway fits in this top grower list as well, with its 50.6%, and Germany at 43.2% yearly growth, but we’ve already talked about those. The one other country reaching the top 10 in EV sales growth is quite a large market itself:

Italy: 94 624 EVs sold in 2025, growing +44,2% year-over-year. The EV market share rose from 4,2% to 6,2%.

This is nice to see. Italy is the third-largest car market in Europe, but ninth in EV sales in Europe, so the EV growth there is a welcome sight, especially after remarkably flat EV sales in 2024 compared to the year before.

These were the top growth markets in EV sales in Europe in 2025, but let’s take a look at all the other markets that didn’t fit into any of these categories, or even slowed down in EV sales:

From Growing to Declining EV Markets in Europe

Austria: 60,651 EVs sold in 2025, growing +35,9% year-over-year. The EV market share rose from 17,6% to 21,3%.

Austria goes steady towards its EV peers, marking a very good and stable year for EV sales in 2025.

Ireland: 23,601 EVs sold in 2025, growing +35,2% year-over-year. The EV market share rose from 14,4% to 18,9%.

After a significant drop in 2024, it is great to see Ireland is back on track with its EV transition, and quite strongly so.

Hungary: 11 002 EVs sold in 2025, growing +28,5% year-over-year. The EV market share rose from 7,0% to 8,5%.

Hungary is one of the few countries in Europe where EV sales growth has been steady, even in the years when most European countries experienced a downturn.

Latvia: 1 602 EVs sold in 2025, growing +27,3% year-over-year. The EV market share fell from 7,3% to 7,1%.

Latvia showed solid unit growth with 27.3%, but the rest of the car market actually grew more year over year, leading EV share to drop slightly.

Czechia: 13 806 EVs sold in 2025, growing +26,5% year-over-year. The EV market share rose from 4,7% to 5,6%.

Czechia keeps going, but the pace has slightly slowed down in the second part of 2025: the EV market grew 70% in 2023, another 63.5% in 2024, but ended at 26.5% growth in 2025. At 5.6% EV adoption, however, the country has a long way still to go.

Portugal: 52 256 EVs sold in 2025, growing +25,1% year-over-year. The EV market share rose from 19,9% to 23,2%.

Very solid growth from Portugal in 2025, continuing on an EV path they have been on for years now. Nearly every fourth car sold in Portugal is now fully electric!

The EV uptake should be boosted even further by the recent regulation change allowing the charging industry to develop more freely. Tesla and other charging operators have already started increasing the nationwide charging network significantly.

Cyprus: 1 474 EVs sold in 2025, growing +23,6% year-over-year. The EV market share rose from 7,9% to 10,1%.

Cyprus continues to show strength, as after more than doubling in 2023 (+115.9%), it gained another +51.5% in 2024 and now +23.6% in 2025. The EV market share has moved from 5.35% in 2023 to 10.1% in 2025, meaning every 10th car sold in Cyprus is now fully electric.

Switzerland: 53 250 EVs sold in 2025, growing +15,4% year-over-year. The EV market share rose from 19,3% to 22,8%.

While the 15.4% in growth in EV sales units doesn’t seem like much, the 3% jump in the EV market share, taking from the ICE market, is significant still. Switzerland is now back at its 20%-something EV market share that it had in 2023.

Greece: 8 892 EVs sold in 2025, growing +2,1% year-over-year. The EV market share fell from 6,4% to 6,2%.

Greece went steady this year, recording a small decline in the latter part of the year. The country recorded a huge 126% growth in EV sales in 2023, followed by a 36.5% growth in 2024, and seems to have stayed roughly the same throughout 2025.

Luxembourg: 12 663 EVs sold in 2025, declining -0,9% year-over-year. The EV market share fell from 27,4% to 26,9%.

While this year recorded a slight decline, Luxembourg’s recent years that got it here have seen a significant EV market share rise: from 15.2% (2022) → 22.5% (2023) → 27.4% (2024).

It’s okay to take a gap year, Luxembourg, as long as you’ll keep going in 2026!

Romania: 8 849 EVs sold in 2025, declining -9,7% year-over-year. The EV market share fell from 6,5% to 5,6%.

Romania is one of the five countries in Europe where EV sales declined in 2025, and here, policy changes are to blame as well. More specifically, the sudden suspension of the Rabla Plus 2025 programme.

Croatia: 1 266 EVs sold in 2025, declining -29,4% year-over-year. The EV market share fell from 2,8% to 1,8%.

Croatia is an odd market to watch, completely different currently from the rest of Europe. It takes the ‘negative record’, both almost in EV units sold, with its second-largest decline year-over-year in Europe, and remaining the lowest EV market share across all countries. It isn’t great to see the market share drop from 2.8% to 1.8%, let’s see if there’s more uptake in 2026. Eleport is certainly preparing for it, having just opened the largest charging site in Croatia.

Estonia: 868 EVs sold in 2025, declining -34,2% year-over-year. The EV market share rose from 5,2% to 6,6%.

Estonia is in a weird place, car market-wise. The drop in EV sales by units, -34.2% is quite a significant one in that, but the EV market share actually rose for Estonia, from 5.2% to 6.6%. Here, the introduction of the car tax has created some distortions in the market that should be smoothed out in the coming years.

EV Sales in Europe 2025 meant another record year in the books.

After what you could call a “gap year” in a lot of European markets in 2024, we can see 2025 make up for it and more!. Of the 31 markets that we gathered for the Europe EV sales 2025 overview, only five showed a decline in EV sales, and European sales grew by nearly a third in 2025.

What to look for in EV growth from the year 2026?

The EV adoption is cyclical, and each country has its own cycle. We saw it clearly with 2024 being an EV slowdown year for so many markets in Europe, while in 2025, most of them jumped significantly.

On the one hand, the relaxation of emission targets in Europe can mean some drawbacks in the urgency of carmakers to bring more EVs to the market, but on the other hand, there is, just now, a large list of different competitive EV models arriving on the roads, which should help adoption significantly.

The EV transition steps at a different pace across Europe, as we’ve seen in our analysis above. But while the pace of the EV transition can be different in each country, its outcome is the same all around. All electric.