Picture this. Your neighbor bought an electric vehicle from a brand you have never seen before.

It turns out it’s for a reason, as he explains: it’s a Chinese car. The sales for it started in Europe last year, so no wonder you haven’t seen it.

Wow, that seems like a risky bet. But is it really?

The reality is that this sight will become increasingly common throughout Europe. The trend is clear, and the new entries in our auto market have come to stay.

As I’ve kept a close eye on all EV industry development, I saw this coming and called it out already around four years ago – and today, these China-made electric vehicles are popping up in our neighborhoods from brands like BYD, XPeng, NIO, MG, Leapmotor, Zeekr, and more.

To be clear, our article here is not an ode to Chinese electric cars in Europe. Rather, it is a try at an honest overview of the intricacies surrounding Chinese EVs in Europe, the good and bad. There’s a lot more going on here than one would assume.

The “surprising” Rise of Chinese EV Makers

In the European automotive industry, there’s no doubt left that China has “suddenly” – which in this case means visibly over the past few years and over decades in the background – become an auto manufacturing power to be reckoned with. Until recently, pretty much the only Chinese EVs that Europeans were buying were Teslas, and even then, most had no clue they were shipped here from the Shanghai Gigafactory.

Now, the choice of Chinese EVs in Europe is becoming abundant, and this coincides with the advent of the new era of electric vehicles, something in which the Chinese industry has become a superpower.

We’ve come to a point where the old stigma of Chinese cars being the cheap knockoff copies of the West is completely broken, and a lot of the actual innovation around new electric vehicle models and technology comes straight out of China. They have worked themselves up.

This is also evident by the European auto industry realizing they need to partner up with Chinese makers to not stay behind – as we saw with the Volkswagen – XPeng investment and partnership, or the Stellantis – Leapmotor joint venture. The latter has brought Leapmotor’s EVs to Stellantis’ dealerships all across Europe already.

The automakers across the two regions now collaborate both on the software as well as on the battery and electrical architecture side of the electric vehicles.

Are They Any Better?

Although there is a lot of innovation coming out of China, both on batteries – Europe only holds a very small percentage of EV battery production domestically – and on the drivetrain and electrical architecture of the cars themselves, I am not saying the European automakers are dead in the water here. But they do have competition, and in certain aspects, it seems Europe might be falling behind.

Another aspect of Chinese EVs in Europe is how surprisingly digitally advanced they are.

We know the fresh approach Tesla brought to the car industry with a strong software-defined approach, lots of vehicle controls being on the infotainment screen and launching many of the features for the car that were never accessible before, starting with the ‘dog mode’ and ending with the Sentry mode which records everything in and out of your car by multiple cameras when it’s locked by default.

Sitting in the XPeng X9 minivan in München at the IAA event two months ago made me realize that if they come to the market in a similar price range as our local ID. Buzz, which I believe they will, there would be massive interest in the vehicle.

It felt rather luxurious, with the massaging zero-gravity seats in the middle row, the scent sticks for the vents, and the overall feel of the vehicle. The X9 also felt high-end on the technology side, starting with the large pop-down screen from the ceiling to the actual fridge under the middle console that can do both cooling and heating.

Not to mention the Tesla-like software itself, of course. All this is especially remarkable considering what it goes for (starts at ~€44k in China). The comparison to Buzz is exactly what the sales reps asked me about after testing.

The Chinese EVs nowadays have taken this software-defined game to a whole new level, and we’re seeing some European automakers trying to follow the same route, from seamless apps and infotainment systems to smart frunk opening features and large screens filled with, honestly, surprisingly useful gadgets.

As for the ‘regular’ things to care for when it comes to cars, or electric cars specifically, a strong warranty scheme that tends to be on par with the European makers, will help get rid of that potential trust issue.

Chinese EVs in Europe are Gaining Traction, but Tariffs Pushed the Ratios

The western automakers used to have a strong sales base in China… before EVs came along. Nowadays, most Western automakers have seen significant drops in sales over the past years, because they are no longer able to compete in the world’s largest car market, which is China. The domestic EV makers are just taking that market share for themselves.

And when those automakers that got “big enough” in China, with some excessive capacity produced, they started to trickle into Europe and the rest of the world.

In the first half of 2025, China reached a 30,8% fully electric market share of sales domestically, and those ~3,35M EVs sold there made up 56,5% of all EVs sold globally. To compare, Europe made up 20.1% of EVs sold globally, with 1,19 million in the first half of 2025.

Now, while the sales trends of Chinese EVs in Europe might be clear for now, they are still very far from dominating here – there are no Chinese battery electric vehicle (BEV) models in the top 25 sold so far. However, in May this year, BYD already broke into 12th place in the brand leaderboard for BEVs in Europe, MG took 17th place and XPeng and Leapmotor made it to 24th and 25th, respectively.

In the second quarter of 2025, the Chinese brands made up 8% of the BEVs sold in the European Union per EV Volumes data; however, this data excludes two notable EV markets of Norway and the UK, both of which also have a stronger Chinese EV presence.

The vehicles out of China that we see incoming here in Europe are nearly all either battery-electric (BEV) or plug-in hybrids (PHEVs). This reflects the domestic market mix of sales, where the two drivetrain types, which in China are jointly called New Energy Vehicles (NEVs), take up around 50% of all sales now.

And the influx of battery-electric vehicles was winning out as that’s what the Chinese automakers importing were focusing on – until recently, when the European Commission (EC) added significant tariffs on Chinese car imports, but specifically on the BEVs. These tariffs are applied on top of the regular 10% vehicle import tariffs, and are different depending on each automaker, based on the findings of the EC’s investigation into the subsidies the carmakers have received for production from the Chinese government.

The problem with these tariffs?

They apply only to battery-electric cars, and not to plug-in hybrids. This led to an obvious incentive for the Chinese automakers to pivot and start importing plug-in hybrids to Europe.

I personally will never understand why the European Commission would make such a clearly anti-climate decision, given that the average plug-in hybrid, based on real-world data over 127,000 PHEVs driving in Europe, emits 5 times more gCO2 /km than their WLTP emission numbers on paper.

The proof that these tariffs created more imports of PHEVs over BEVs in Europe is visible in the latest Eurostat numbers: in the first half of this year, the Chinese car imports showed a €1.36B worth of rise for hybrids, yet a €1.34B worth of decline in pure electric vehicles.

This means that for the time being, we will see more plug-in hybrids and fewer battery EVs come our way, which will likely later change back.

A clear way around the tariffs, which was likely also one of the goals of the European Commission here, is domestic production. Soon, you’ll be able to buy a Chinese EV… made in Europe. Most notably, BYD is finishing its first plant in Hungary in 2026 and is also building one in Turkey. Stellantis’ joint venture with Leapmotor already produced the T03 in Stellantis’ plant in Tychy, Poland, and is now moving to a larger production in Zaragoza, Spain, starting next year as well. Chery will also be building its EVs in Barcelona as a joint venture with Ebro.

Do They Use Regular Dealerships and Service Networks?

If you didn’t see your first EV at your neighbors’ or even anywhere on the road, chances are you might’ve stumbled upon them at some regular and well-known dealership showrooms. One of the ways these brands have entered Europe is by partnering with the well-known distributors across the countries, such as Inchcape, which works with 60 automotive brands.

Inchcape notably works with BMW across 13 markets, with Ford and Citroën and the like, yet now also counts BYD, XPeng, and GAC out of China as partners among others. Going to shop for a BMW? You can stumble upon a test drive of a BYD next door.

While the rollout of these Chinese EV brands across all of Europe varies, especially in our Central and Eastern Europe, their plans are currently clear: to scale up. And to overcome the stigma around Chinese EVs in Europe, or the fact that most of these Chinese electric car brands in Europe are unknown to local buyers, they are partnering up with known dealer networks where possible.

At the IAA Mobility event in München, Germany, just a few months ago, I saw BYD showcasing how they will achieve presence in 32 European countries with over 1000 stores by the end of 2025, with plans to reach over 2000 stores in 2026. The Chinese automakers’ presence in the event, usually dominated by European automakers, was notable.

If you look at XPeng and NIO, or other similar companies inbound, the focus on expanding the network is quite fast and clear, sometimes adding five or more countries in one announcement – much like NIO did just recently for ten new European countries. For Central and Eastern Europe (CEE), NIO will partner with AutoWallis, entering Austria and Hungary in 2025 and Czechia, Poland, and Romania in 2026.

With this, NIO has started to mix its direct-to-consumer approach it had done before, with large partnerships instead. A similar approach can be seen from most Chinese makers. With the exception of Tesla, which does still import its Tesla Model 3 from China while Model Y is made in Berlin, but handles all its showrooms and services itself as it’s done from the start.

Are the Chinese EVs safe for European Roads and Owners?

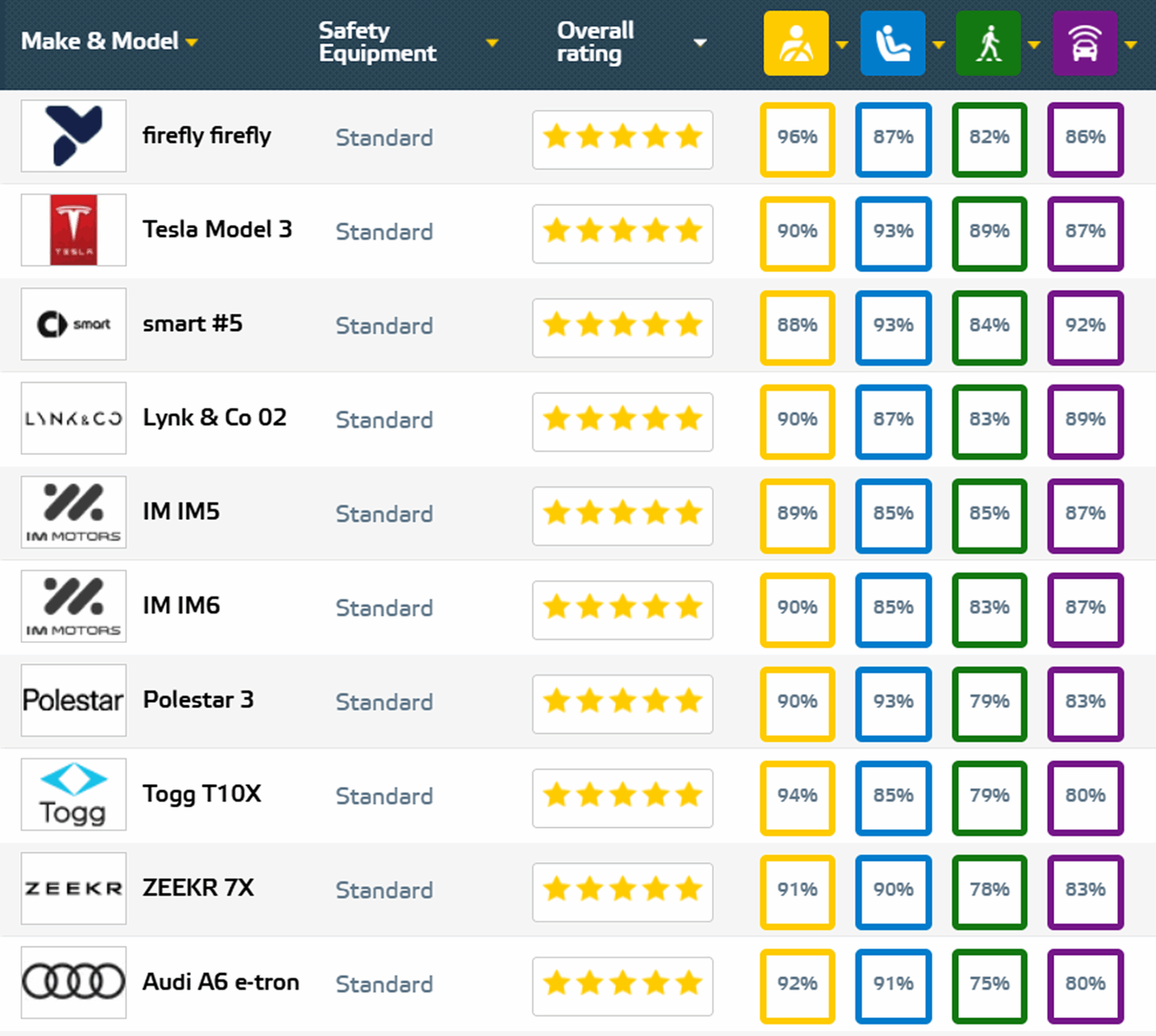

Perhaps a slightly surprising aspect of the Chinese EVs in Europe is that they tend to score very high on the official safety tests here. Not quite what would be usually expected here.

From the EuroNCAP, which is a known crash testing body for a wide selection of new car models on European roads, I counted that 25 of the 47 vehicles tested so far from the year 2025 that got a maximum five-star safety score are the Chinese electric cars in Europe.

All this means is that, although exceptions likely will remain as in every industry, the Chinese EVs aren’t a workaround for safety regulations in Europe; instead, they seem to be scoring quite high among the locals all on their own.

The “firefly firefly” you see in the first position of rankings there? It’s this little bug from the NIO subsidiary, which is surprisingly spacious considering the small dimensions:

Are the Chinese Electric Cars in Europe Cheaper to Buy?

Yes… and no.

While the Chinese EV makers are indeed mostly coming in hot and competitive to European markets, often undercutting the local equivalents somewhat to win customers and make them overlook the lack of brand loyalty as they’re new, the prices are not usually showing a huge difference compared to European makers. Especially when comparing to ICE models, as we all know, EVs start at a higher price point on average anyway (which they, of course, make more than up for in lifetime use).

However, we are not currently unlocking the true low cost of Chinese EVs in Europe, as the very same models we have on sale in Europe can be around at least 20% or, in some case,s even up to 2 to 3 times cheaper in China domestically.

If calculating the prices these EVs start at in China, you might end up really drooling for such a deal, as the value vs price would be immense. However, with import costs (including the tariffs), the costs of entering the new European markets, and the higher local running costs, we are yet to see the “ridiculously cheap” versions of the EVs that you might spot selling in China.

Here’s an example based on the second-best-selling EV in the world, the small BYD Seagull, which is the cheapest model BYD offers: it starts at 56 800 yuan in China, which is around €6900. In Europe, however, the same model starts at €22 990, and even if there are a few more bells and whistles on the same car, there are no vehicles in the segment that even come close to the €7000 range.

I expect the BYD Dolphin Surf, which will roll out from the Hungarian plant soon, will cause a significant competitive pricing run in its respective segment.

Let’s take a look at another segment on this, the best-selling EV in the world from 2023 and 2024 – the Tesla Model Y: In China, a Tesla Model Y RWD starts at 263 500 yuan (€32 165), but in Europe the same model starts at €41 490. That’s a 29% increase in price for the same car, just depending on where you buy it.

We will see whether the Chinese EV makers will be able to push the European EV prices down or not.

Potential Problems – Surveillance? Politics? Trust? Brand? Subsidies?

There will certainly be people who will say right out of the gate – they will never consider a vehicle from a Chinese brand. They have strong reasons, and that’s understandable. We’ll explore a few of the potential ones below.

Here are a few of the usual arguments that might hinder sales of Chinese EVs in Europe:

- Unknown brands – that’s a big one. The more progressive buyers are willing to buy one even with less history, but a large part of auto buyers are actually loyal to the brands they know. Chinese makers have a lot to catch up here, but building a good track record, tie-ups with local dealers, and local automakers help.

- Can I trust a Chinese EV? A lot of Europeans consider China a surveillance state. And with the new digitalization of cars beyond just making them electric, there are more cameras and digital interfaces in a car to spook some owners over potential privacy issues. The brands need to overcome this fear.

By default, the Chinese EVs in Europe are also held to the GDPR privacy standards of Europe, and the fresh EU Data Act from Sept 12, 2025, states that connected products, including cars, must let users access and share the vehicle-generated data with third parties they choose, with protections for security and trade secrets. - Politics – a lot of people vote with their wallets. And depending on their view of the country where the car is made, they might skip the purchase just based on the current politics around it.

- Cut off from Subsidies – some incentive structures in Europe are specially designed to only allow domestically manufactured EVs to take place, such as in France, which puts the Chinese electric cars in Europe at a disadvantage. Until they start making the cars domestically, that is.

- Higher attention – one bad actor or incident can ruin the success of many. If there are negative events around any of the Chinese electric cars in Europe that can tarnish a brand’s image, it might also do so collectively against the others.

So, if Your Neighbor Buys a Chinese Electric Car in Europe

If your neighbor buys a Chinese electric car in Europe, perhaps it’s best to ask them more about it. If you’re considering one, among the domestic makers, for your next purchase, you will gain a good comparison between our regular offerings. If you’re completely certain you’ll never buy a Chinese EV, I would still go and ask your neighbor about it.

Why should you ask your neighbor about his Chinese EV? It’s because many of the features and technologies you see are likely going to end up in our domestic automakers’ vehicles very soon, too. Our local makers learn and adapt some of their best features.

And as we always say, the best way to test any EV is to drive it for a while – butts in EV seats is exactly what gets the EV adoption going.