Update: As we expected, already putting together our half-year 2025 EV sales analysis below, the full year of 2025 broke new records in EV transition, with every 5th car sold in Europe ending up fully electric. See our complete updated Annual analysis of EV sales in Europe 2025 here.

Despite the headlines often downplaying the momentum of EV sales in Europe, the real results across Europe in the first half of 2025 have shown strong growth in almost all countries. In fact, out of the 31 European countries we analyzed below, only 5 showed a decline in EV sales compared to last year.

However, to set the stage, globally, 5.9 million battery electric vehicles have hit the road in the first half of this year. That’s a growth of 29.1% in EV sales in the world, compared to the first half of 2024.

1 190 346 of these 5,9 million sold in Europe. European EV sales grew 24,9% in the first half of 2025, compared to the 954 094 sales in the first half of 2024.

EV market share in Europe is now 17,5%. In other words, every 6th (well, every 5,7th) car sold in Europe is currently fully electric! A year ago, the EV sales in Europe made up just 13.9% of all sales.

This is a strong signal that we are still on the right track when it comes to EV adoption, especially as there was no real growth in EV sales in Europe in 2024. If we look at the big picture, it is clear that the EV future is already here – it is just unevenly distributed.

With the EV adoption, charging stations are ramping up too, as Europe recently reached one million public charging points deployed. Now, let’s take a look at which countries are leading the EV growth in Europe, and which countries seem to be sitting this year out.

* Note: all values for “EV” here are meant as battery-electric vehicles (BEVs) only. Not plug-in hybrids (PHEVs) or any ICE in the data. You can learn more from the EV vs ICE comparison.

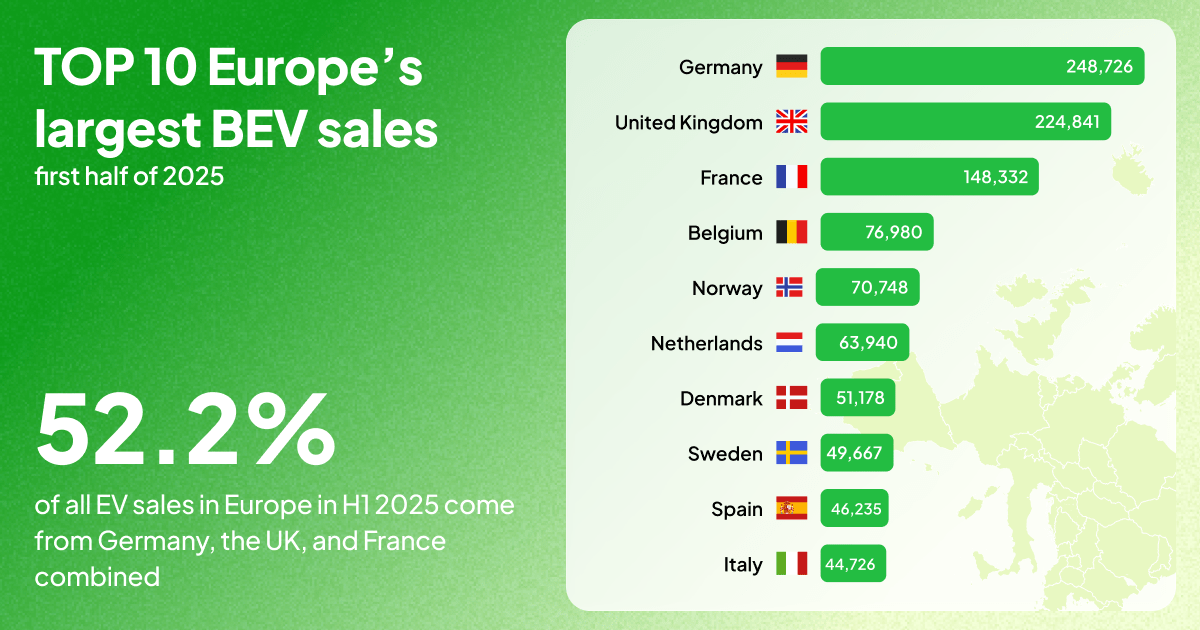

The big three: largest EV markets in Europe

We’ll start breaking down our Europe EV sales 2025 overview with the three countries where EVs are sold most in terms of units. In fact, put together, these Big Three countries make up 52.2% of all EV sales in Europe:

Germany: 248 726 EVs sold in Jan-June 2025, growing +35,1% year-over-year. The EV market share rose from 12,5% to 17,7%.

Germany is the largest car market in Europe, and also the largest in EV sales in Europe. It is interesting to watch Germany’s EV path for obvious reasons – it is where most of our EVs are made, after all. It is especially interesting today, given the rollercoaster ride the EV sales have had in the country recently.

What happened in Germany’s EV sales in 2024? There was a strong 18.4% → 13.5% EV market share drop in 2024, caused mostly by the environmental bonus incentives for EV purchases being suddenly axed mid-December 2023. Luckily, we are seeing a strong bounce back to 17.7%, which means every 6th car sold in Germany is now fully electric.

Next comes the country that even managed to snatch the title from Germany for the last year in EV sales in Europe (it was a close call), but is now back in second place:

United Kingdom: 224 841 EVs sold in Jan-June 2025, growing +34,6% year over year. The EV market share rose from 16,6% to 21,6%.

The growth rate for the UK seems to be accelerating here, as 2024 and 2023 both showed “just” growth in the 20% range. The market share jump by 5% so far this year is especially significant considering that we are dealing with a large car market here. Every fifth car now sold in the UK is fully electric!

The third spot in units in Europe is taken up by the fourth-largest car market in Europe:

France: 148 332 EVs sold in Jan-June 2025, declining -6,4% year-over-year. The EV market share rose from 17,3% to 17,6%.

What has caused a large market like France to record one of the rare drops in EV sales in Europe this year? First off, what is notable here is that although the overall EV sales showed a decline from the first half of last year, the EV share of all cars actually increased slightly.

Part of the slowdown might be caused by the uncertainty due to the announcement of the ecological bonus ending from 1 July 2025, plus a pause and later re-launch of social leasing scheduled for late September. With its 17.6% EV market share, France closely matches the Europe EV sales share average of 17.5%.

We’ll continue our European EV sales overview with the ones that have already figured out the formula and are truly leading the market in terms of adoption:

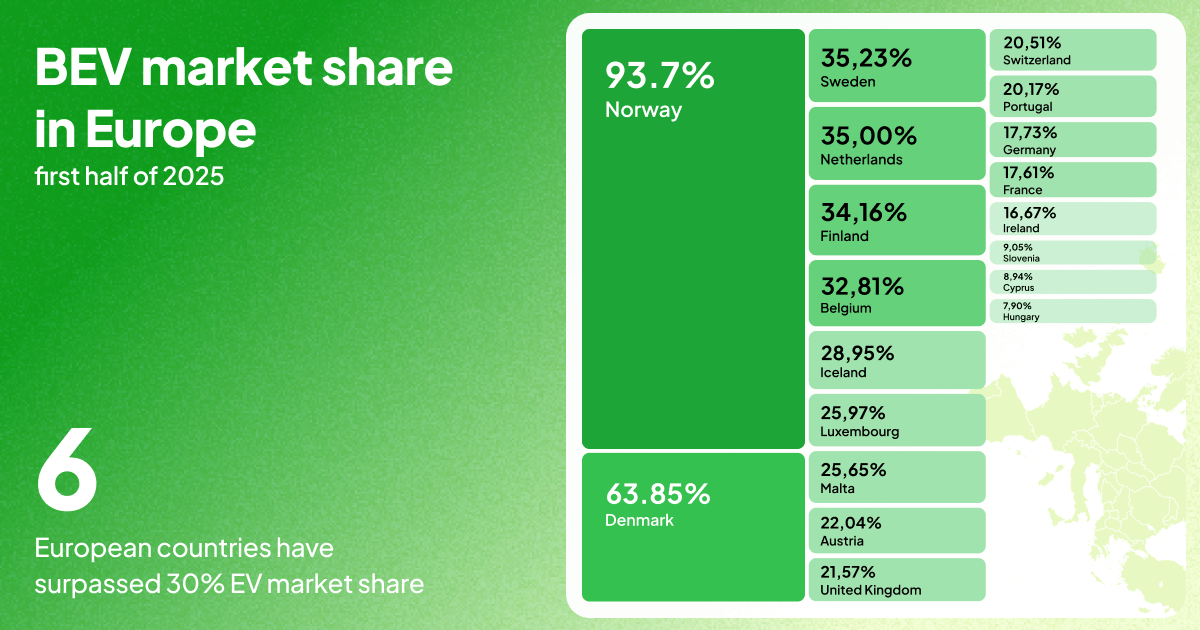

Six European Countries Are Already at Over 30% EV Adoption

As you already know, the first place in Europe’s EV market share, and in the world, belongs to Norway.

Norway: 70 748 EVs sold in Jan-June 2025, growing +37,6% year-over-year. The EV market share rose from 84,9% to 93,7%.

The 93.7% EV market share means that every 16th car that is sold in Norway is now not a fully electric vehicle. There’s no doubt that Norway has figured out what it takes, and how, to live with electric cars. Not only is Norway leading in EV sales in Europe in terms of market share, but the country also keeps its first spot on the whole planet.

However, there has been another major success story in terms of EV sales in Europe by market share that has not gotten the attention it deserves:

Denmark: 57 178 EVs sold in Jan-June 2025, growing +46,9% year-over-year. The EV market share rose from 45,1% to 63,85%.

This means nearly two out of every three cars sold are fully electric in Denmark. And here, the increased share that EVs have taken out of the car market is especially visible, with an 18,8% jump just from one year to the next! This is the largest EV market share jump out of all the countries we analyzed in Europe’s EV market this year.

Sweden: 49 667 EVs sold in Jan-June 2025, growing +18,25% year-over-year. The EV market share rose from 31,75% to 35,2%.

Every third car sold in Sweden is now fully electric. Also, did you notice how it is somehow the colder parts of Europe that are claiming the largest EV adoption? So much for EVs not working in cold! EV sales in Europe up north are directly proving the myth busted.

Netherlands: 63 940 EVs sold in Jan-June 2025, growing +6,1% year-over-year. The EV market share rose from 31,2% to 35,00%.

The Netherlands, one of the ‘original’ EV growth markets in Europe, continues on its path among the top, more than every third car sold fully electric.

Finland: 12 726 EVs sold in Jan-June 2025, growing +20,4% year-over-year. The EV market share rose from 27,0% to 34,2%.

Finland did it again.

After showing the largest jump in EV market share in 2023 when it went from 17.8% → 33.75%, then experiencing a drop back to 29.3% last year, the country is back in the EV growth phase. The 7% jump in the EV market share means every third new car hitting the road in Finland is now fully electric.

Belgium: 76 980 EVs sold in Jan-June 2025, growing +19,5% year-over-year. The EV market share rose from 24,45% to 32,8%.

EVs have taken over Belgium by storm in the past few years. Consider that in 2022, only 9.8% of all cars sold there were electric, jumped to 19.6% in 2023, then another leap to 28% in 2024, and they have reached 32,8% EV market share today.

If comparing to the average EV sales in Europe in 2025 which achieved a ~17.5% market share, these six countries are twice or more ahead in EV adoption.

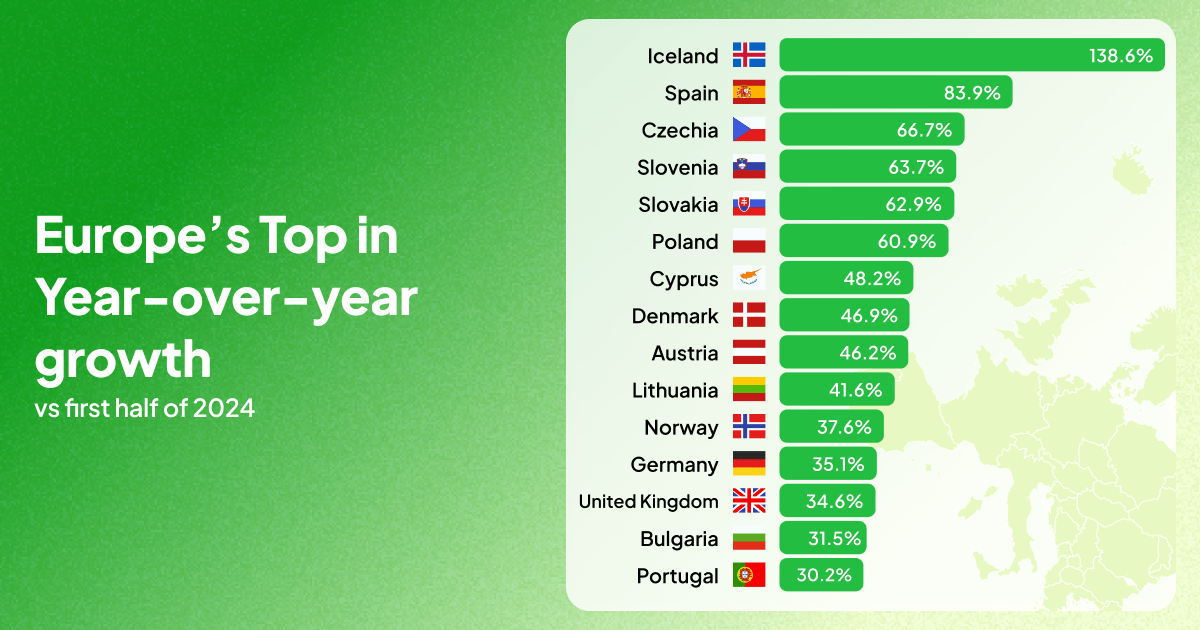

European countries with the largest EV growth in 2025

Now, let’s switch gears and see which countries have been growing fastest this year in EV sales in Europe:

Iceland: 2 283 EVs sold in Jan-June 2025, growing +138,6% year-over-year! The EV market share rose from 15,1% to 28,95%.

Iceland’s EV journey has been fascinating to watch. In 2023, Iceland ended up with 50% of all cars sold fully electric… and then by the turn of the year, the government imposed a €0.04/kilometer charge on EVs and revoked the VAT exemption. This caused a significant drop back to 26% EV market share in 2024.

But now, even though EVs got knocked down like this, the sales are still climbing back up: 29% of all Iceland’s car sales were fully electric in Jan-June 2025, and the country recorded the highest EV growth rate in EV sales in Europe in 2025.

Spain: 46 235 EVs sold in Jan-June 2025, growing +83.9% year-over-year. The EV market share rose from 4,70% to 7,6%.

It’s always great to see large car markets find their EV gear, and Spain, the fifth-largest car market in Europe, nearly doubling its EV sales, fits that well. The Spanish market still has a strong incentive scheme, and it also extended the MOVES III scheme in April 2025 until the end of this year, so we are expecting the strong uptake to continue. So far this year, Spain has recorded the second-largest growth in EV sales in Europe.

Czechia: 6 910 EVs sold in Jan-June 2025, growing +66,67% year-over-year. The EV market share rose from 3,5% to 5,6%.

Czechia just keeps going: the EV market there grew 70% in 2023, another 63.5% in 2024, and is now looking to repeat that even this year. One of the steadiest EV transition growths we’ve seen over the past few years. However, Czechia is earlier in its story line. At 5.6% EV adoption, it has a long way still to go.

Slovenia: 2 700 EVs sold in Jan-June 2025, growing +63,7% year-over-year. The EV market share rose from 5,8% to 9,05%.

After almost doubling EV sales in 2023 (+88.8%), a significant downturn followed in 2024, which made the EV market share drop from 8.85%→5.9%. Now, it is climbing back again with a strong 2025 ahead.

Slovenia and Slovakia seem to move in a very similar step, the latter being just a step earlier on the EV market share ladder:

Slovakia: 2 008 EVs sold in Jan-June 2025, growing +62,85% year-over-year. The EV market share rose from 2,6% to 4,45%.

As you can see, the EV sales in Europe this year are growing most in the unexpected markets, especially in the CEE region.

Poland: 14 256 EVs sold in Jan-June 2025, growing +60,9% year-over-year. The EV market share rose from 3,2% to 5,0%.

Poland also took a break in 2024 after growing 51.3% in 2023, and the EV market share even declined from 3,6% to 3% last year. Now, the sales are heading in the right direction with a strong 60.9% growth rate.

Cyprus: 735 EVs sold in Jan-June 2025, growing +48,2% year-over-year. The EV market share rose from 5,6% to 8,9%.

Cyprus continues to show strength, as after more than doubling in 2023 (115.9%), it gained another 51.5% in 2024 and now +48.15% in the first half of this year. The EV market share has moved from 5.35% in 2023 to 8.9% in H1 2025.

Denmark would be added to this list with its +46,9% growth, but we already covered the country above.

Austria: 31 534 EVs sold in Jan-June 2025, growing +42,2% year-over-year. The EV market share rose from 16,4% to 22,0%.

Austria also finds EV growth after a slow 2024, and achieved a significant +5.6% EV market share jump that took it even further than its peer, Switzerland, which has historically been a bit ahead in adoption.

Lithuania: 1 205 EVs sold in Jan-June 2025, growing +41,6% year-over-year. The EV market share rose from 5,76% to 5,80%.

Lithuania’s situation looks great at first, with a significant 41.6% growth in sales, but looking closer, it seems that the EV sales growth just matched the overall car sales growth, as the EV market share barely moved in the first half of 2025, staying at 5.80%. However, this is still a welcome result after a 7.6% to 5.9% drop in EV share in 2024.

From Growing to Declining EV Markets in Europe

While we’re in the Baltics, Latvia does, as is often the case in EV sales, follow a similar path to Lithuania.

Latvia: 743 EVs sold in Jan-June 2025, growing +26,8% year-over-year. The EV market share fell from 6,73% to 6,61%.

Latvia showed solid unit growth with 26.8%, but the rest of the car market actually grew more year over year, leading EV share to drop slightly.

On the other hand, Estonia did the opposite:

Estonia: 444 EVs sold in Jan-June 2025, -31,6% year-over-year. The EV market share rose from 6,4% to 7,2%.

Notable here is the drop in EV sales by units, 31.6% is quite a significant one in that, but the EV market share actually rose for Estonia, from 6.4% to 7.2%. Here, the introduction of the car tax has created some distortions in the market that should be smoothed out along the way.

Italy: 44 726 EVs sold in Jan-June 2025, growing +28% year-over-year. The EV market share rose from 3,9% to 5,2%.

Italy is the third-largest car market in Europe, but tenth in EV sales in Europe, so the EV growth there is a welcome sight, especially after remarkably flat EV sales in 2024 compared to the year before.

Portugal: 25 017 EVs sold in Jan-June 2025, growing +30,2% year-over-year. The EV market share rose from 16,5% to 20,2%.

Very solid growth from Portugal so far this year, continuing on an EV path they have been on for years now. Every fifth car sold in Portugal is now fully electric!

The EV uptake should be boosted even further by the recent regulation change allowing the charging industry to develop more freely. Tesla and other charging operators have already started increasing the nationwide charging network significantly.

Switzerland: 23 203 EVs sold in Jan-June 2025, growing +8,49% year-over-year. The EV market share rose from 17,6% to 20,5%.

While the 8.5% growth in EV sales units doesn’t seem like much, the 3% jump in the EV market share, taking from the ICE market, is significant. Switzerland is now back at its 20%-something EV market share that it had in 2023.

Ireland: 13 629 EVs sold in Jan-June 2025, growing +26,9% year-over-year. The EV market share rose from 13,6% to 16,7%.

After a significant drop in 2024, Ireland is back on track with its EV transition.

Hungary: 5 219 EVs sold in Jan-June 2025, growing +12,2% year-over-year. The EV market share rose from 7,35% to 7,9%.

Hungary is one of the countries where EV sales growth has been steady, even in the years when most European countries experienced a downturn.

Luxembourg: 6 559 EVs sold in Jan-June 2025, growing +1,9% year-over-year. The EV market share rose from 25,6% to 26,0%.

While this year has been mostly stagnant so far, Luxembourg’s recent years that got it here have been with significant EV market share rise: from 15.2% (2022) → 22.5% (2023) → 27.4% (2024).

Greece: 4 265 EVs sold in Jan-June 2025, growing +27,7% year-over-year. The EV market share rose from 4,3% to 5,5%.

Greece has a steady upward trend in EV sales as well, with a huge 126% growth in EV sales in 2023, followed by a 36.5% growth in 2024 and solid growth so far this year.

Romania: 3 201 EVs sold in Jan-June 2025, declining -44,3% year-over-year. The EV market share fell from 6,9% to 4,9%.

Romania is one of the five countries in Europe where EV sales declined in the first half of this year, and here, policy is to blame as well. More specifically, the sudden suspension of the Rabla Plus 2025 programme.

Bulgaria: 1 135 EVs sold in Jan-June 2025, growing +31,5% year-over-year. The EV market share rose from 3,7% to 4,7%.

After a strong +119% EV growth year in 2023, Bulgaria took a step back in 2024 with 8% less EV sales. This year, it seems to be making up for it and more, with 31.5% growth for the first part of the year.

Malta: 805 EVs sold in Jan-June 2025, -35,0% year-over-year. The EV market share fell from 29,9% to 25,65%.

Malta’s strong decline in EV units is significant, but it should be considered that this comes after almost doubling sales in 2024, and the little island country went from already significant 20.3% → 37.7% market share in just one year. Now, we will see if the drop continues or will turn back to mimic last year’s success.

Croatia: 396 EVs sold in Jan-June 2025, -50,0% year-over-year. The EV market share fell from 2,0% to 0,94%.

Croatia is currently the absolute last in EV sales in Europe, both in EV units sold, with its largest decline year-over-year in Europe, and the lowest EV market share across all countries. However, to end this on a high note, a new €21,2 million subsidy program for zero-emission vehicles was announced for Croatia just in mid-August, which might help the market along.

EV Sales in Europe 2025, Will It Be a Record Year?

| Country | BEV sales in first half of 2025 | Year-over-year growth (vs H1 2024) | EV market share |

| Σ Europe (EU+EFTA+UK) | 1,190,346 | 24.90% | 17.47% |

| Germany | 248,726 | 35.10% | 17.73% |

| United Kingdom | 224,841 | 34.60% | 21.57% |

| France | 148,332 | -6.40% | 17.61% |

| Belgium | 76,980 | 19.50% | 32.81% |

| Norway | 70,748 | 37.60% | 93.69% |

| Netherlands | 63,940 | 6.10% | 35.00% |

| Denmark | 57,178 | 46.90% | 63.85% |

| Sweden | 49,667 | 18.30% | 35.23% |

| Spain | 46,235 | 83.90% | 7.58% |

| Italy | 44,726 | 28.00% | 5.23% |

| Austria | 31,534 | 42.19% | 22.04% |

| Portugal | 25,017 | 30.20% | 20.17% |

| Switzerland | 23,203 | 8.50% | 20.51% |

| Poland | 14,256 | 60.90% | 5.00% |

| Ireland | 13,629 | 26.90% | 16.67% |

| Finland | 12,726 | 20.40% | 34.16% |

| Czechia | 6,910 | 66.70% | 5.63% |

| Luxembourg | 6,559 | 1.90% | 25.97% |

| Hungary | 5,219 | 12.20% | 7.90% |

| Greece | 4,265 | 27.70% | 5.46% |

| Romania | 3,201 | -44.30% | 4.94% |

| Slovenia | 2,700 | 63.70% | 9.05% |

| Iceland | 2,283 | 138.60% | 28.95% |

| Slovakia | 2,008 | 62.90% | 4.45% |

| Lithuania | 1,205 | 41.60% | 5.80% |

| Bulgaria | 1,135 | 31.50% | 4.71% |

| Malta | 805 | -35.00% | 25.65% |

| Latvia | 743 | 26.80% | 6.61% |

| Cyprus | 735 | 48.20% | 8.94% |

| Estonia | 444 | -31.60% | 7.21% |

| Croatia | 396 | -50.00% | 0.94% |

After what you could call a “gap year” in a lot of European markets in 2024, this year is already looking to make up for it and more. Of the 31 markets that we gathered for the Europe EV sales 2025 overview, only five showed a decline in EV sales, and European sales grew by a quarter in the first half of 2025.

The EV transition steps at a different pace across Europe, like we’ve seen above, and also on the global scale: we are seeing exceptional EV adoption rates from Singapore to Ethiopia, from Brazil to Nepal. China, the largest car market, is growing incredibly fast towards an EV future, and currently makes up over half of all EV sales on the planet.

And while the pace of the EV transition can be different in each country, its outcome is the same all around. All electric.